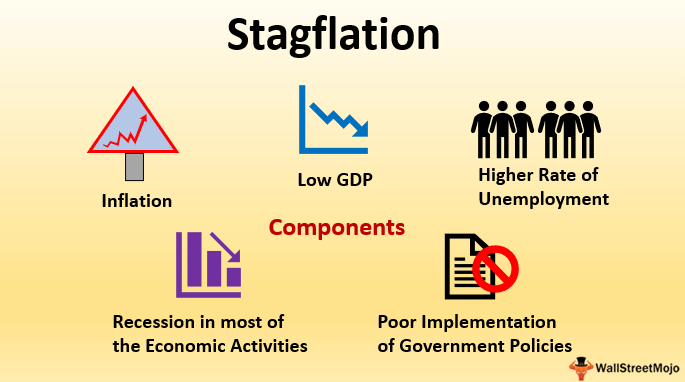

STAGFLATION

What to expect when inflation and a recession happens at the same time

When inflation and a recession happen at the same time, it is called stagflation. In stagflation, the economy experiences both rising prices and a slowdown in economic activity, which can create challenges for individuals, businesses, and policymakers. Here are a few things to expect during stagflation:

- Rising costs: Inflation can cause the prices of goods and services to increase, which can lead to higher costs for consumers.

- Decreased purchasing power: As the value of money decreases due to inflation, individuals may have less money to spend on goods and services, leading to a decrease in consumer spending.

- Job loss: During a recession, businesses may lay off workers or go bankrupt, leading to a decrease in employment.

- Decreased investment: In times of economic uncertainty, businesses and individuals may be less likely to make investments, which can further slow down economic growth.

- Increased government intervention: In an effort to combat stagflation, governments may take steps such as increasing government spending, reducing taxes, or lowering interest rates to stimulate economic activity.

- Increased borrowing costs: Inflation can lead to higher interest rates, which can increase the cost of borrowing for businesses and individuals.

The highest interest rates in the United States occurred in the late 1970s and early 1980s. During this time, the Federal Reserve raised interest rates in an effort to combat high inflation, which had reached double-digit levels. The federal funds rate, which is the interest rate at which banks lend money to each other overnight, reached a high of 20% in June 1981.

This period of high interest rates had a significant impact on the economy, leading to a recession and increased borrowing costs for individuals and businesses. However, the Federal Reserve's actions helped bring inflation under control, and interest rates gradually declined over the next few decades. Today, the federal funds rate is much lower, currently 4.33%

Overall, stagflation can be a challenging economic environment, and it's important for individuals and businesses to prepare and adjust their spending and investment strategies accordingly.